Framing the tax debate

December 13, 2010

Congresscritters are debating tax policy with typical dishonesty. If this nation is to survive, the first step must be holding liberals accountable for their use of language.

Congresscritters are debating tax policy with typical dishonesty. If this nation is to survive, the first step must be holding liberals accountable for their use of language.Tax “cuts”

There are no tax cuts under discussion. The expiring so-called “Bush tax cuts” were passed in 2001 so those tax rates have been the law of the land for nine years. At some point the rates are the rates and it’s a little silly to talk about those rates as “cuts.” If the Democrats in congress don’t get off their asses and allow this legislation to pass, we will—all of us—see large additional bites out of our paychecks in a couple weeks. That’s called a tax “increase.”

Even the one-year lowering of social security withholding that President Obama is proposing isn’t really a tax “cut” because social security is not a tax to fund government. It’s supposed to be a retirement savings account. [Insert disdainful snicker here.] It’s actually a bankrupt federally-run Ponzi scheme but, nevertheless, the amount you draw as a retiree is determined by how much you paid into the fund so reducing the amount you pay for a year will merely reduce the amount you eventually collect (theoretically). Instead of a tax cut, the president is basically suggesting that you spend your retirement money early—so it will invigorate the economy—so maybe he can get reelected in two years.

Like any of us need encouragement to be unwise about saving money for retirement.

“Wealthy” people

Democrats are wailing about the rates for “wealthy” people. Socialist Senator Bernie Sanders (Listen, Vermonters, if you don’t like freedom and individual rights, move to China instead of sending socialists to congress, okay?) filibustered for eight hours and thirty one minutes Friday, wailing the whole time about “wealthy” people getting a tax cut.

Bernie needs a dictionary because he obviously doesn’t understand what the word “wealthy” means. “Wealthy” refers to somebody who has accumulated substantially more wealth than other people—in other words, people who already collected their money and are set. “Wealthy” means people like John Kerry, or the Kennedys, or Bill Gates, or Warren Buffet, all of whom want higher tax rates. The income tax rates under discussion don’t tax wealth, they tax income. Duh. Raise the tax rates to 100% and Bill Gates will still be wealthy and his lifestyle will remain exactly the same. No wonder he doesn’t care about a tax increase.

Income taxes take money from the poor slobs who are working like dogs in the hope that maybe—just maybe—someday they might accumulate a bit of wealth themselves. Why should they be punished because they’re working hard and doing well? And why do people like Bernie Sanders think they have any right to determine how much money somebody else earns? And confiscate part of it?

Imagine a hard working American who scrimped and saved and labored for painfully low compensation for twenty years trying to make a successful business. His wife and children went without new clothes, they ate cheap and vacationed little, lived in a small house they could afford, and spent their money wisely to make it stretch. And now, finally, his business is successful enough to earn him $300,000 a year just in time to start paying for the kids’ college (there’ll be no scholarship help because of his income, of course), and along comes some nasty-piece-of-work little socialist from Vermont who says they’re making too much money and should pay a higher tax rate to help the profligate foolish government cover its deficits.

Get lost, Bernie. I’ll buy your plane ticket to China.

“Cost” of lower taxes

There is a word game that liberals play when they talk about taxes. A lower tax rate is labeled a “cost” as though all earnings everywhere actually belong to the government. So lower rates “cost” the government by giving more money to the people who earned it.

Think about it for two seconds: this word game says more about the liberal viewpoint on individual property rights than about financing government. Every time they use the word “cost” in reference to lower tax rates, they might as well have a neon sign on their forehead saying “I’m a communist!”

Unemployment “stimulus”

Whether you fall on the side of extending unemployment benefits—again—or fall on the side that says they must end eventually or the fundamental nature of America will be irrevocably changed, one thing should not confuse the debate: unemployment benefits do not stimulate the economy.

Rather than summarize the extensive economic theory which insists that government spending is never stimulative, we can simply ask a logical question: If unemployment benefits are good for the economy, why don’t we all quit our jobs and collect unemployment money from the government?

Man, would the economy ever take off then!

Whose money is it?

The fundamental question confronting the United States is who owns the money we earn? Do we still have private property rights or not? We are quickly sliding into a socialist mindset where senators and presidents can talk about the money that somebody earns as though it belongs to an unfeeling monolithic collective rather than the person who earned it.

If there is one thing we learned from the evils of the Soviet Union and Red China, it’s that the collective never stops wanting more from the individual. Needing more from the individual. Demanding more from the individual. Taking more from the individual.

Until finally the individual is merely a slave.

We look back at the Middle Ages and pity the serfs who were forced to labor on landowners’ farms as little more than alternatively-titled slaves but a quick review of serfdom reveals that serfs were typically required to work one or two days per week for the landowner. That’s all. The rest of the time they could work on their own farming.

One day per week equates to about a 14% tax rate. Two days would be a 28% rate. Here in America, supposedly the Land of the Free, where we laugh at serfs in Monty Python movies, government spending has grown to more than 50% of gross domestic product. Who’s laughing now?

From Reno, Nevada, USA

December 27, 2010 - "Government 'help' to business is just as disastrous as government persecution... the only way a government can be of service to national prosperity is by keeping its hands off." -Ayn Rand - Hard Case, Michigan

December 14, 2010 - You suck. - Turtle Dove, Minnesota

December 13, 2010 - Pretty funny... I'm sitting her reading your website while CNN is on and I heard three politicians in a row talk about the tax "cuts" and how much they will "cost" the government, and one of them mentioned that extending unemployment is okay because THAT will stimulate the economy. It's like they were providing live examples to accompany your column! - Peter M., Virginia

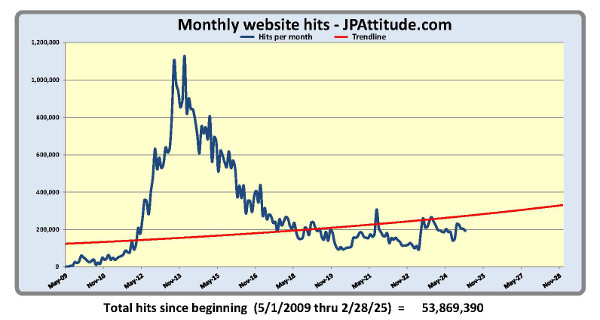

J.P. replies: See, this is why JPAttitude is the best website on the Internet—we have readers intelligent enough to quote Ayn Rand in the comments section.

December 14, 2010 - You suck. - Turtle Dove, Minnesota

December 13, 2010 - Pretty funny... I'm sitting her reading your website while CNN is on and I heard three politicians in a row talk about the tax "cuts" and how much they will "cost" the government, and one of them mentioned that extending unemployment is okay because THAT will stimulate the economy. It's like they were providing live examples to accompany your column! - Peter M., Virginia